DCP was pleased to host a recent Property Market Briefing for our investor network, featuring a presentation from Trent Cropley, Head of Industrial Valuations at JLL, alongside DCP Managing Director Ed Bull.

The session provided valuable insight into Brisbane’s evolving industrial property market, including current yield trends, rental growth patterns, and land sales activity—reinforcing DCP’s strategy of targeting assets that offer planning or repositioning potential.

ABOUT THE SESSION

Trent Cropley offered an evidence-based outlook on the state of the industrial sector, particularly in South East Queensland. Despite sharp increases in land values, continued population growth, and limited appropriately zoned land, prices are expected to sustain value over the longer term – albeit with moderated growth compared to the previous cycle.

KEY TAKEAWAYS

Industrial Rental Growth Trends: Brisbane industrial rents have risen consistently since Q1 2021:

- Trade Coast: $120/sqm → $196/sqm (Q1 2025)

- Southern Brisbane: $110/sqm → $160/sqm (Q1 2025)

- North Brisbane: $108/sqm → $180/sqm (Q1 2025)

Hardstand Lease Activity: Hardstand rents have grown substantially across Brisbane alongside underlying land value increases. Recent hardstand lease rates:

- Port of Brisbane: $95/sqm gross

- Trade Coast: $65/sqm net

- Darra: $70/sqm net

Owner-Occupier Investment:

As a result of rising land and build costs, Owner-Occupiers are now transacting on existing assets with pricing over $4,000/sqm for vacant sheds, with limited land supply, time, and construction risk making this a viable alternative.

Capital Value Outlook: Despite average prime yields softening from 4.50% to 5.75% over the past two years, capital values have continued to rise, driven by strong growth in industrial rents during the same period.

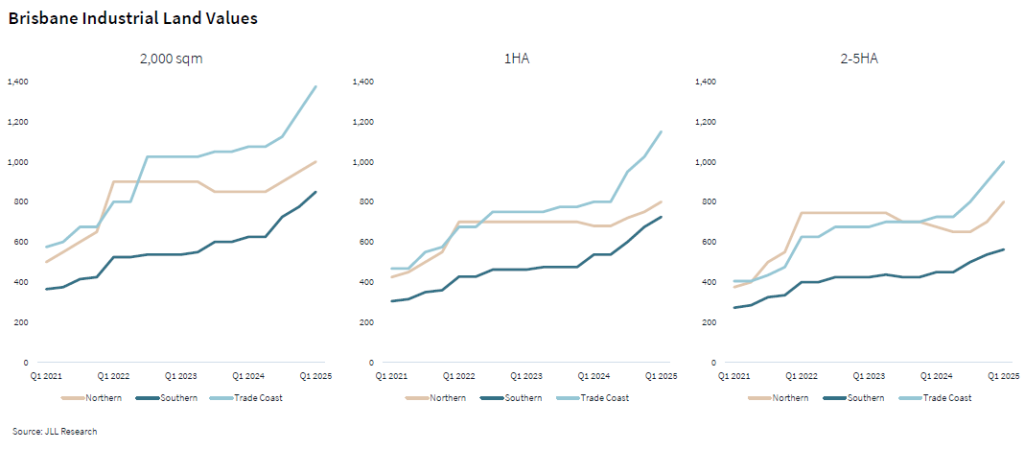

Industrial Land Values: Industrial land values across all parcel sizes have grown in all Brisbane industrial precincts, as depicted by the graphs below.

WHAT IT MEANS FOR INVESTORS

These insights reflect DCP’s strategic focus: identifying land and assets that can be repositioned through planning uplift, leasing optimisation, or redevelopment. The industrial market continues to offer opportunities for those who understand the local supply constraints and value drivers.

If you’d like to know more, contact Ed Bull – edbull@dcpinvest.com.au or 0438 619 692